Eligible Taxpayers Receive Stimulus Payments, Check Your Status

Introduction

The American Rescue Plan Act of 2021, signed into law by President Biden on March 11, 2021, provides eligible taxpayers with another round of economic stimulus payments amidst the ongoing COVID-19 pandemic. These payments are intended to alleviate the financial hardships faced by individuals and families during this unprecedented crisis.

Eligibility Criteria

To be eligible for the stimulus payment, taxpayers must meet the following criteria:

- Have a valid Social Security number

- Have an Adjusted Gross Income (AGI) below $75,000 for individuals, $150,000 for married couples filing jointly, and $112,500 for head of household filers

- Not be claimed as a dependent on someone else’s tax return

Payment Amount

The stimulus payment amount varies based on the taxpayer’s filing status and income. Individuals with an AGI below $75,000 will receive $1,400, married couples filing jointly with an AGI below $150,000 will receive $2,800, and head of household filers with an AGI below $112,500 will receive $2,000.

For dependents, the stimulus payment is $1,400 per eligible child or other qualifying relative. Dependents must meet the same Social Security number and income requirements as the taxpayer.

Payment Schedule

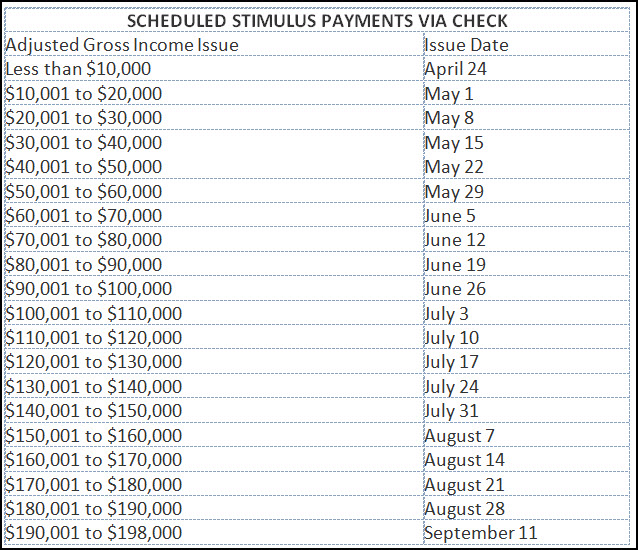

The IRS has begun issuing stimulus payments, and most eligible taxpayers will receive their payment automatically through direct deposit, mail, or debit card. The payment schedule varies depending on the individual’s tax filing history and the method of payment.

Checking Payment Status

Taxpayers can check the status of their stimulus payment using the IRS’s “Get My Payment” tool at IRS.gov/getmypayment. This tool allows taxpayers to track the status of their payment, confirm the amount they will receive, and update their payment information if necessary.

Impact and Perspectives

The stimulus payments are expected to provide significant financial relief to eligible taxpayers, especially those who have lost income or faced other economic hardships due to the pandemic. However, there are concerns that the payments may not be sufficient to address the long-term economic consequences of the pandemic.

Different perspectives on the stimulus payments include:

- Economic Stimulus: Proponents of the stimulus payments argue that they will provide much-needed support to households and businesses, boosting economic growth and preventing a sharp decline in consumer spending.

- Inequity: Critics argue that the stimulus payments are inequitable, as they provide larger payments to higher-income taxpayers who have been less affected by the pandemic, while providing smaller payments to low-income taxpayers who need the assistance the most.

- Moral Hazard: Some economists express concerns that stimulus payments may create a moral hazard, discouraging people from working or seeking alternative sources of income. However, research suggests that this effect is minimal.

Conclusion

The stimulus payments under the American Rescue Plan Act are a significant effort to provide financial relief to eligible taxpayers amidst the ongoing COVID-19 pandemic. While they may not address all the economic challenges faced by individuals and families, the payments are expected to provide a much-needed boost to consumer spending and support the economic recovery.

However, it is important to consider the different perspectives on the stimulus payments to ensure that they are equitable and do not have unintended negative consequences. Ongoing monitoring and evaluation are necessary to assess the long-term impact of the payments and make adjustments as needed.